The beginning of the year is a great time to take stock of your family finances. It doesn't take much for spending to get out of hand: it can be as simple as visiting the food truck one too many times because you're too rushed to pack a lunch, or your kid getting invited to way more birthday parties this year (read: purchasing more gifts). If left unchecked, these little things can add up fast.

We're all about planning ahead so that we can reap the rewards later, and we want to share some of our favorite family budgeting tips with you, so that you can begin to pay off your debt, get a head start on saving for big things like college or a house, begin to build wealth through investing, and maybe even set some fun financial goals, like saving for vacations and experiences.

First things first, schedule a monthly budget meeting

Whether you have a partner, or are a single parent, setting some time aside where you can focus on your finances without interruption is key. This might mean a budget date after the kids are asleep, or else planning to work on the budget when they're visiting grandma. Whatever you do, make sure to commit to a time where you can give your finances your full attention.

While the idea of talking finances with your partner might fill you with dread, we promise that regular conversations about financial planning will actually alleviate a lot of the stress around the topic. Go into the meeting with an agreed upon agenda so that everyone involved can come prepared. Bringing a positive and collaborative attitude about the future helps to minimize friction. Bringing snacks also helps - no one likes budgeting when they're hangry.

Identify your goals

Every family is different and there's no one-size-fits-all approach to family finances. A good place to start is to identify your goals. Also remember to think about your goals from a perspective of needs versus wants. You need to save for emergencies. You want to go to Hawaii.

Are you still struggling with your own student debt and a pesky credit card or two? If so, you'll likely want to prioritize debt repayment. Do you have the equivalent of 6 months of your income saved for emergencies? If not, you might want to focus on building your emergency fund. If you have your debt and emergency fund under control and are looking to build wealth; identifying opportunities for investment might be your goal.

Discuss this together and then use the tips below that are relevant to you as stepping stones toward that goal.

Create a basic budget

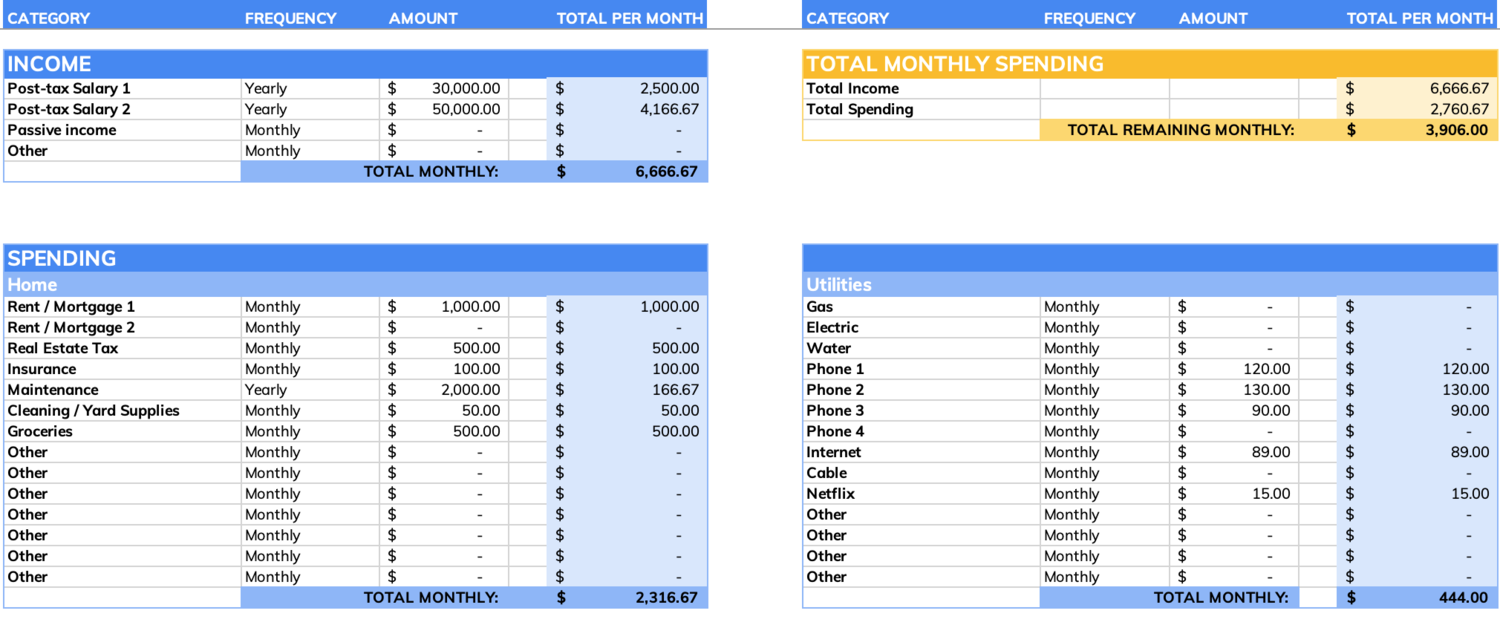

Decide on a budget tracking method that everyone involved can understand and access. Whether you use a shared spreadsheet, a notebook, or an app is totally up to you. Not sure where to start? We've created this

simple budgeting spreadsheet template which makes it really easy to see where your money is going each month. (Don't have Excel? You can open this spreadsheet using Google Sheets.)

Begin by listing your monthly income, and then subtracting all of your monthly expenses, debit orders, and debt repayments. Don't forget to list all of your subscriptions, like Netflix, Amazon Prime, and the various apps on your phone. Go into the app store and see which apps you've subscribed to that have recurring charges - chances are, you could probably cancel some of those subscriptions right then and there.

Walletfi is a handy app for managing subscriptions and recurring charges.

Identify fixed expenses (ex. rent) and variable expenses (ex. groceries). Understanding how your variable expenses can change from month to month can help you better prepare for a more expensive month.

Listing out your expenses will give you an idea of how much money is left at the end of the month to put towards your main budget goal, as well as putting aside money to a "slush fund" to help you avoid paying with credit when you have a month with higher variable expenses.

Prioritize paying off debt (If you don't have debt, work on not accruing debt)

Take a leaf from Dave Ramsey's book, and use the snowball method to tackle your debt. Check out this

great infographic on the topic.

- List all of your outstanding debts (except your mortgage) and the interest rate for each.

- Arrange your debt from the smallest amount outstanding to the largest.

- If you have two (or more) debts with very similar amounts of outstanding, take a look at the interest rate of each. Whichever debt has the highest interest rate should rank as "smaller" in your debt ranking. This means that when using the snowball method, the debt with the higher interest rate will get paid off sooner, costing you less in interest.

- Make the minimum payment on all of your debts, except the smallest one. If you've been paying off these larger debts at more than the monthly minimum you can adjust these amounts in your budget.

- Now look at how much money is left in your budget. By how much can you commit to increasing the payment on your smallest debt? For example, if you're paying off a credit card at $100 per month minimum, can you actually afford to pay that card off at $150, or even $200 a month? If so, add that new number to the credit card payment line in your budget and commit to it.

- Once the smallest debt is paid off, that doesn't mean you now have $200 extra to spend each month. You'll take the $200 you were paying, and roll it over onto the next smallest debt. So you'll be paying the minimum PLUS $200.

- Continue doing this until you're debt-free.

Don't forget to keep track of all these payments in your monthly budget.

Plan for your child's future

If you have kids it's never too early to start saving for college. If you don't currently have a line item in your family budget for college savings, take a look at what is left over after monthly expenses and commit to a manageable monthly deposit into a college savings account and add it to your budget. No amount is too small - these things add up over time!

Pro tip: By using a state-run 529 college saving plan, you can save up to 6 times more money than if you use a regular savings account. If that's not enough to convince you, 529 plans have tax-free earnings and will have the least impact on your child's financial aid eligibility.

Shameless plug: Don't have a financial advisor? Not sure where to start? We've got you! Scholar Raise makes signing up for a state-run 529 plan super simple. In just 5 minutes you could be on your way to saving effectively for college and all you need is the information on your driver's license & your social security number. No advisor fees, no account minimums. You could even set up an account during your budget meeting.

Building Wealth

If you've got your debt and emergency fund under control, now's the time to think about building wealth. Try to allocate as close to 10% of your income as you can to a long-term savings/investing plan - add that amount to the investment line item in your budget. Don't feel bad if you're still paying off some debt and are not able to save a full 10% right off the bat. As long as you contribute something to your investments each month. Once you've paid off your debt, you'll have a lot more money left to add to your investments.

If you aren't sure where to start,

ElleVest and

Betterment take the guesswork out of investing and are FAR more cost effective than a traditional financial advisor.

Pro tip: If you have a 401K with your employer, don't forget to ask about employer matching. Find out based on your tax margin, whether pre-tax (traditional 410K) or post-tax (Roth IRA) makes the most sense for you.

Setting Additional Financial Goals

If you have anything left over at this point, you can start setting additional financial goals that make sense for your family. Don't forget to consider want vs. need!

Family vacations toe the line between need and want, as they are a great way to spend uninterrupted quality time together and make lifelong memories - but you don't need to go skiing in Italy to do that. A trip to a local cabin, or even doing a house swap with a relative who lives in another town could be just as fun, and might be a better fit for your budget this year. Maybe that trip to the Alps can become a longer-term savings goal instead?

Same goes for cost-prohibitive extracurriculars for you & your kids. Of course you want the best for your family, but living beyond your means to send your child to equestrian camp, or for you to be part of a traveling sports league is not a smart idea.

If your interests are beyond your budget, that doesn't make you a bad parent. Look for creative ways in which you can begin to expose your family to the things they're interested in without breaking the bank. Volunteering, open-days, community events, and work trade opportunities (if your child is old enough) are all great places to start. Always ask for scholarship or sponsorship opportunities.

Teach your kids

Now that you've set up your budget to keep your family financially fit, why not teach your kids about budgeting? We're not saying that your kids should be part of the parent budget meeting, but setting some time aside to work with them on their own budget is an invaluable life skill that will serve them for the rest of their lives. For more on how to teach your children to budget, check out

this blog.