Remember a time when planning five years out seemed like a stretch? Then you became a parent; where five years goes by faster than a toddler who's just been asked what's in their mouth. But no-one got into this game because they're afraid of a little planning.

Parenting is all about planning, from remembering to pack Goldfish for even the shortest car trip, to planning out the next 18 years of their life. Much like forgetting your kid's snack, failing to plan for their college savings could end up in tears.

Somebody's gotta pay for your child's future education. Whether you start saving now, or take out student loans later, somebody is going to be benefitting from the interest in a big way. Question is, do you want that person to be your child? Or the bank?

Let's unpack that...

Financing is essentially the act of making a purchase today, but paying it off over time, plus interest. The interest rate is the premium you pay for the luxury of having time to pay off your purchase. Many things factor into deciding a specific interest rate, this can include the riskiness of the borrower, the duration of the repayment period, and the value of the underlying asset -- for example, you can't repossess a degree obtained with a student loan, but it's easy to repossess a car purchased with a loan.

Saving for a future expense flips this equation around. Essentially you are loaning money to your future self at a discount rate over the time period between now and the time you expect to make your purchase. What's better, is if the time to purchase is long enough (think 10-18 years here) the compounding returns earned on your savings can really add up. Think about it this way, if these numbers make it enticing enough for banks to lend money, they must be pretty attractive. Your future self is good looking, and will thank you for your forward thinking and sacrifice.

So how does this work in practice?

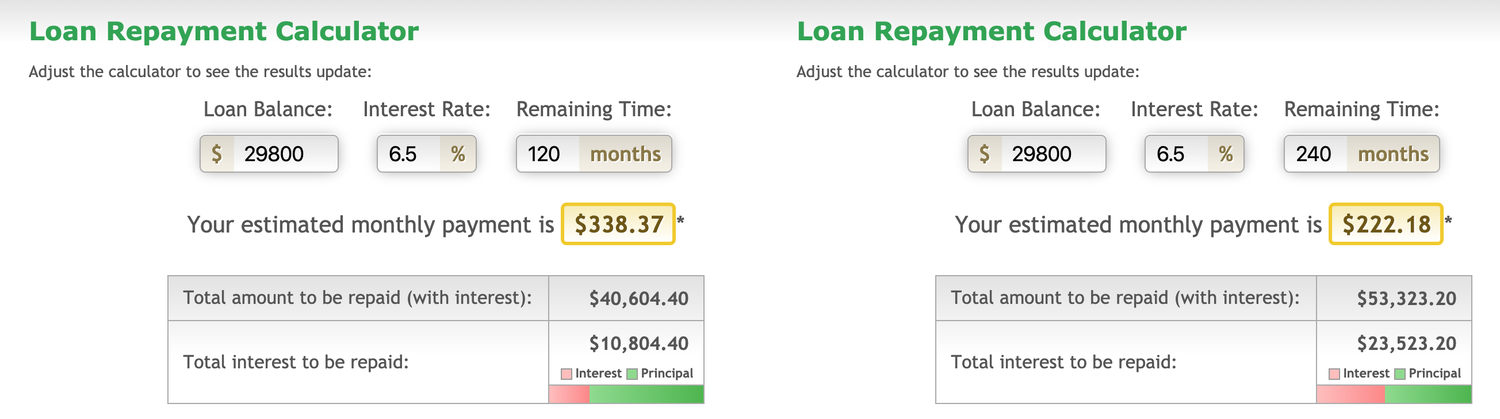

When you take out a student loan, you'll be charged interest on that loan - an average of 6.5% on new loans. For the sake of conversation, let's assume a few basics:

- You're taking out a student loan for the average amount of $29,800

- The interest rate is 6.5% annually

- You're paying it off over either 10 years (left image) or 20 years (right image)

This means, that by not saving for college and relying entirely on student loans, you'll be paying $10,804.40 more for your tuition because of interest over 10 years. If you pay the same loan off over 20 years (which is becoming increasingly common) you'll be paying a whopping $23,523.20 more for your tuition. That's almost double!

Remember, this extra money doesn't go to the school you attend - it lines the pockets of those fat cats at the bank. Tuition prices are steep enough as it is, there's no sense in allowing interest to work against you when with a little planning, YOU could be the one raking in that 6.5%.

Cha-ching! Say what!?!?

Money, even if it's just sitting in your regular savings account, earns returns. These returns are essentially a reward the bank pays you for allowing them to use and lend your money. The best online savings accounts can earn you annual returns of around 1.7%, while the average rate offered by a brick and mortar bank remains at a paltry 0.27%. So while using a regular savings account is better than not saving at all, it's not much better than hiding those savings under your mattress.

If you want to maximize your college savings, a 529 plan is the way to go. Based on

historic figures, a moderate, age-based 529 plan has earned an average of 7% returns annually since inception*. That means that if you deposit $100 this year, next year you could have $107. The great thing about 529 plans is that your returns are compounded. That means you earn returns on your returns. Yes, you read that right, simply by planning ahead, your money will be making money at approximately the same rate the bank would be profiting off your future student loans.

When you think of it that way, the reward for forward thinking far outweighs the reward for remembering to pack those Goldfish and avoiding a meltdown... So what are you waiting for? Your reward is that YOU get to capture the benefit of interest, meaning it will take a lot less of your own hard earned cash to pay your child's tuition fees. The more you manage to save before your kid leaves for college, means less student debt for them. And less student debt for them, means your kid won't be moving back in with you right after graduation because of their crippling debt. Everyone wins!

Not sure where to start?

Scholar Raise makes it simple to set up a 529 plan in just 3 easy steps and you can start saving with as little as $5!

Past performance is not a guarantee of future results