It's that time of year when families and companies alike are finalizing their budgets. For our family, this allows us to account for the regular items plus accounting for kid #2 (eeks), a vacation that doesn't involve a sporting event and maybe some new houseplants. Going through this process is great for children to witness and potentially even participate in so that they continue to gain an understanding around money. While a full family budget is probably a little over their short heads, you can take this opportunity to work on a budget just for them.

Learning how to budget requires the basic conceptual

understanding of expenses, income and the

finite nature of money. If you missed out on our previous blogs around those topics, consider heading back for a quick read as part of your pre-budgeting activities. If you're feeling solid there, read on!

Pre-Budget Activities

- Decide what they are responsible for: A confusing thing for kids of any age is learning what they are responsible for and what their parents will pay for. Discuss and agree in advance which things you, as the parent, will pay for and what your kids will need to spend their own money on. This is a helpful discussion if you also go into the reasoning. For example, my mom always said she would buy me two new pairs of jeans at the start of the school year. "One to wash and one to wear." If I wanted another pair, I would have to pay for it because it was a "want" and not a "need."

- How to Read A Paycheck: As your teens take on official jobs that withhold money for taxes, social security and more - help them understand how this will affect their take home pay. This was something I wish I knew before getting excited about my $10/hr gymnastics coaching job.

- Set Savings Goals: Another Mamma Hahn-ism was to "always save before you spend." She would always say this so that down the road I could afford a big ticket item or have an emergency fund to take care of the things I was responsible for. We would talk in advance about short-term savings goals, like $50 towards a new bike, or long-term goals like saving for college.

- Investing + Building Wealth: It is NEVER too early to teach concepts like compounding interest and how to build your individual wealth. This is something that tends to be skipped over especially for young women, so please teach this early! While state law that you can't manage your own investments until the age of 18 or 21 (state depending), you can help them set up an account and have them participate in the growth of the account. Consider starting a Roth IRA or a simple index fund that they can contribute to their entire life. You could also start a 529 plan in their name (which is essentially an index-fund with many benefits when used for education). They can invest their money and even campaign for the growth of this fund with their family and friends through Scholar Raise. Either way, they'll benefit from the duration the account is open and contributed to.

- Model Contentment: Our society is wonderful in so many ways, but many of us are always wanting more. In one way, this is good so that you keep working and hustling. However, you also have to learn and teach the idea of how to be happy and appreciative with what you have.

Okay, you've done SO. MUCH. PREP. WORK!! Now, let's chat about how to put that into action with a budget.

Budgeting Approach

- Reverse Engineer: Many kids and even teenagers need to focus on an end reward, especially if they're watching their money come and go for a few weeks or more. So consider setting their first budgets for something like:

- Holidays: The gifts they will buy others

- Family vacation: The souvenirs or treats they buy for themselves. My niece was VERY excited to purchase a very VSCO girl shirt from Virginia Beach.

- Dinner: Have your child cook a meal and budget for the ingredients

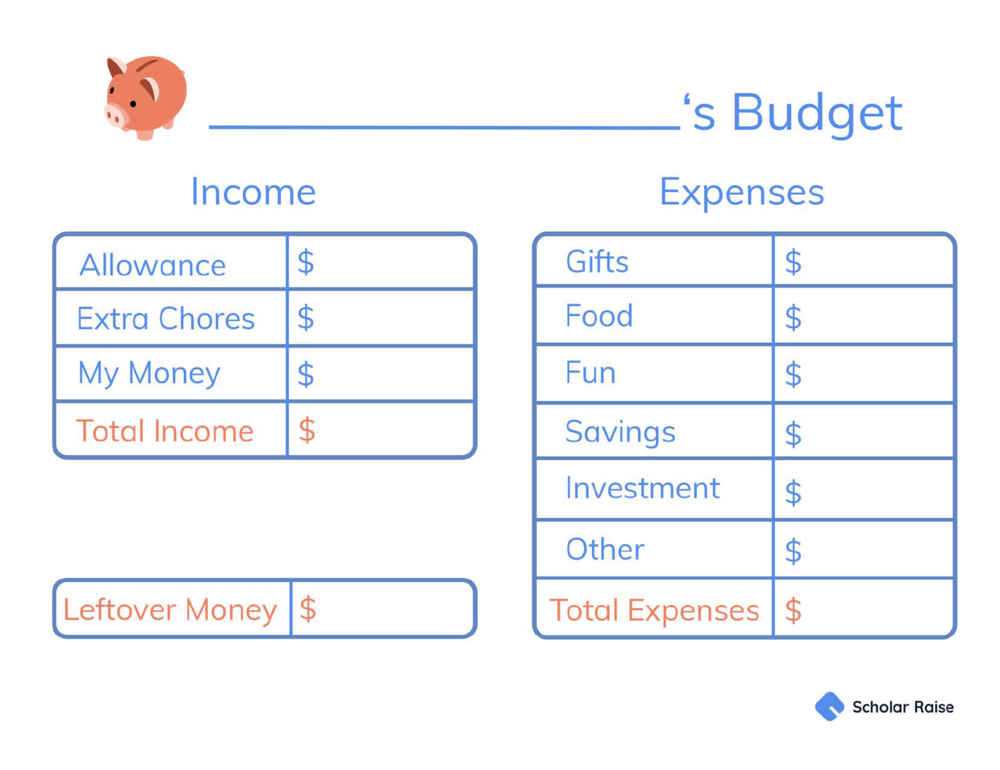

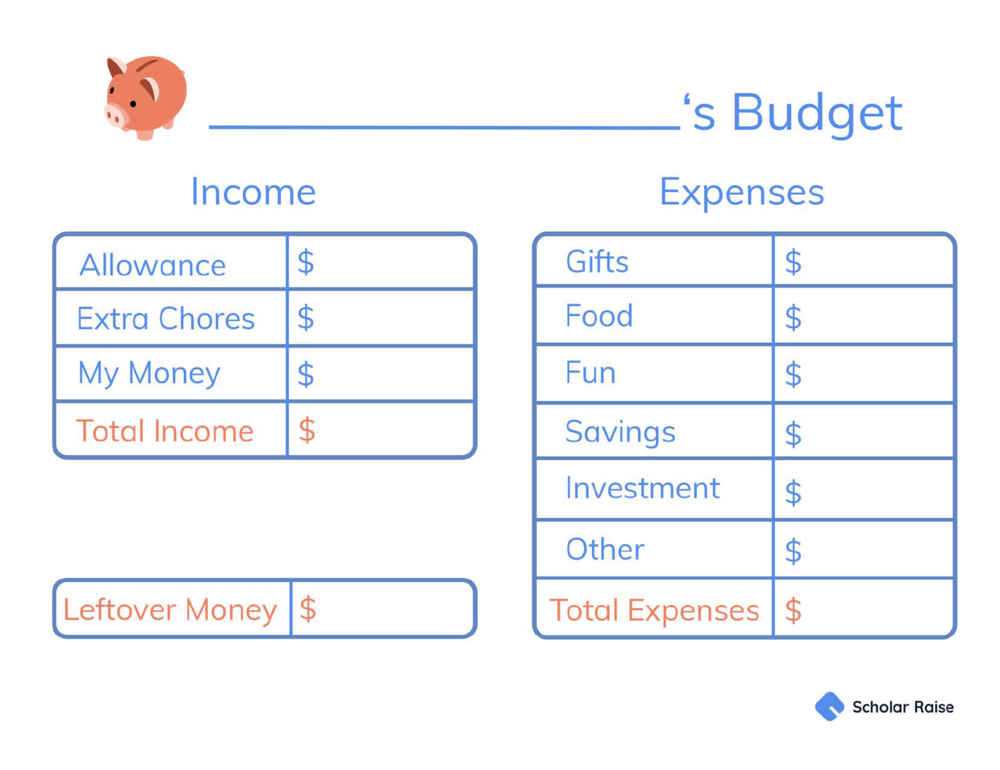

- Two Column Budget: No need to get fancy with a spreadsheet just yet, start with a super simple two column approach (Free Download Here). For the first month, have them track all of the "sources of income" for the month on the left side and do the same with all "sources of expenses" on the right side. At the end of the month, review it to see where they are ending up.

- Pro-Tip: If you are working with a younger child or think a month is too long for them to stay focused on the tracking, reduce the time period for a week and check their inputs each night.

- The Review Period: At the end of the week or month, review your child's budget tracker to see where they are ending up. Just like teaching reading comprehension, kids of all ages do well with open ended questions that challenge their thought process. Apply that same teaching hack here during your review period, ask questions like:

- Good job bringing in money! Are there any other opportunities where you think you could bring in more?

- It looks like some of your expenses change each week, how do you think you could lower them or make them more consistent?

- How did you feel after you made these purchases?

- How do you feel a few days after you made that purchase? (Hint, not regretting a purchase is just as important as enjoying the purchase)

- What do you want to do with your left-over money?

Budgeting will require time on your part, but consider this an investment! You're teaching your child the understanding of "want" versus "need," accountability and a life-long skill. Trust me, it's better to start this now than introduce a credit card later on without this lesson!

Ashley Byrne

Have any comments or additional tips? We would LOVE to hear from you - reach out to us on social media @ScholarRaise.