You've probably noticed that the market is having more trouble making up its mind than a first time Tinder date settling on a dining destination. To be fair, there's a lot going on, what with COVID-19 and the Saudis cutting gas prices (where were these guys when I was putting a buck.87 in my tank and bumping it into neutral coasting to my summer job in the 11th grade?).

Every 17 years or so, the stock market averages around three corrections, which is when stock prices drop by 10% from their recent highs. In the same timeframe, you can also expect a bear market, which isn't as cuddly as it sounds - it's a 20% drop in stock prices, again from their recent highs. It's been 11 years since the last bear market, so while the circumstances surrounding this market downturn are unique (as they always are), the fact is that this is simply part of the stock market circle of life.

Insert Lion King music...

It can be hard to block out all the noise, but hey, you didn't get out in front of all this college savings business only to be deterred by a little market noise - or in this case a shitstorm of market noise. Investing is a lot like parenting, some days it's great, and some days your nerves are tested... it's not for the faint of heart! Being the great parent that your kids know you to be, you know that you need to stay the course and weather the storm on the bad days, because in the grand scheme of things, you'll forget all about that Sharpie family portrait your little one drew on your freshly painted wall. That same steadfastness is required for investing.

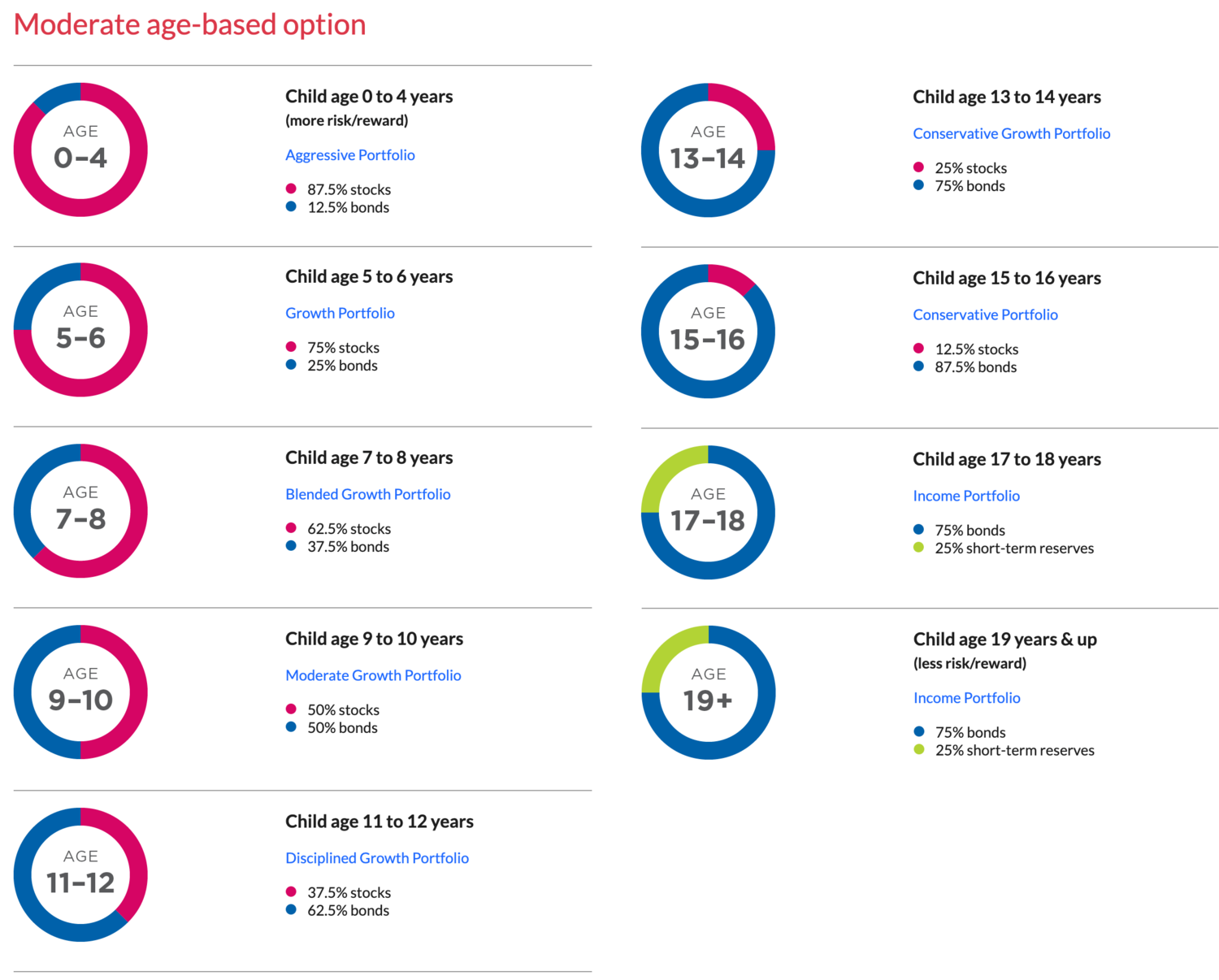

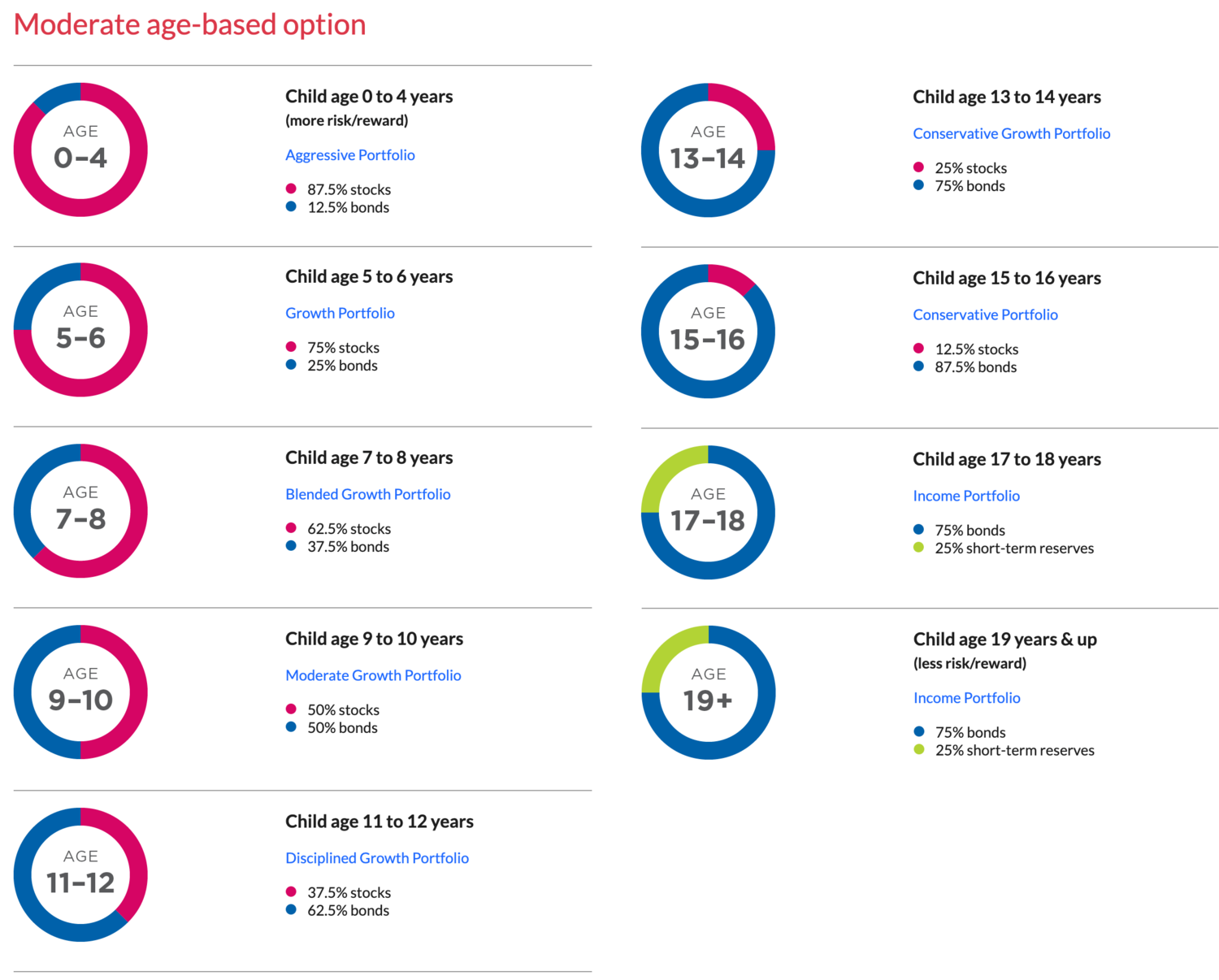

The thing to remember is that saving for college is a marathon, not a sprint. Junior isn't going to college tomorrow, you didn't birth Doogie Howser, did ya? No, you are investing for the long term. What's that you say? Your kid is going to school next year? Fear not, an age-based 529 college savings plan adjusts the balance of assets to earn aggressively when your kid is younger, but become more conservative to protect those gains as your child gets closer to matriculation. What does all this mean? Basically the financial nerds have put a lot of time into ensuring that your 529 is well diversified, and adapt their allocation as Junior approaches college age. Check out the chart below to see how plans are allocated depending on your child's age.

"If you had invested in the stock market from 1999 to 2018, and not touched it, your money would have tripled. But if you had traded in and out and had missed out on just the 10 best stock market days over that period - just 10 days - your returns would have only been half of that. People may think they should wait for a pullback to invest, but the data shows that historically, "time in the market beats timing the market." - Sylvia Kwan

In a nutshell, this is what markets do, and it has proven problematic to try and time the market. Market FOMO is real! Unless your savings goals have changed, you shouldn't need to do anything, you are covered.

Happy Saving!

Wesley Belden

Scholar Raise Founder