If you have kids, or are planning on having kids, it's safe to say you've thought about planning for their financial future and the seemingly unattainable task of successfully saving for their college education. Maybe you've started a savings account? Or you're banking on your kid becoming the next Michael Phelps and getting a full scholarship? Or maybe, like most parents, you've got a couple of crumpled "college fund" checks from the grandparents in the junk drawer waiting to get deposited? Wherever you are in your college savings journey, the info in this blog can take your college savings to the next level - starting today.

First things first, you need a 529 plan.

What's that you ask? Oh it's just the crème de la crème of college savings.

What's the deal with the name? Well, it was created by the federal government and is administered by state treasuries as part of section 529 of the tax code. In short, it's a savings plan, designed to encourage saving for future educational costs like college.

Each state has their own plan and the fees and return on investment can vary. The cool part is, you get to shop around, since the plan you choose isn't dependent on where you live, or where your child wants to go to school.

There are some serious benefits and features to using a 529 plan over other approaches, not the least of which is that out of all possible savings methods, a 529 plan has the least impact on financial aid eligibility.

If you save $10,000 in a 529 plan, your need based eligibility would only be reduced by a max of $564, as opposed to the $2,000 impact that same $10,000 would have if it were in a savings account. Yowza!

Want to save 6 times more with the same amount of money?

That's why you're here, right? With an average 6% annual return and compounding earnings, a 529 plan has much better performance than savings accounts which often earn less than 0.08% per year. That's already a possible 600% increase on your savings, and we haven't even told you the cool part about taxes yet.

Unlike investments or savings accounts, a 529 plan allows for tax-free earnings and withdrawals when used for college expenses, so you get to put every cent you earn towards college, instead of lining Uncle Sam's pockets.

Speaking of investments, you might be wondering if you could earn even more investing in an index fund. Probably not. Don't get us wrong, index funds are a great way to invest. In fact, they're so great, that a large portion of your 529 fund will be invested in them. The difference is, a 529 is an age-based investment. This means that when your child gets closer to college age, your portfolio will automatically become lower risk. This helps you to lock in your earnings, so you don't risk losing them to a volatile market when you need them the most - a.k.a. the time you're likely to make a withdrawal to start paying for college. And don't forget, the taxman will be all over those index fund earnings, like gravy on biscuits, but you get to keep 100% of your 529 plan earnings. Cha-ching!

It's safe to say, between the superior performance of a 529 plan, and tax and aide benefits, you will easily be on your way to saving up to 6 times more for college, without any more money or any more work from your end.

But why stop there? You could be saving even more!

These next two tips can boost your 529 plan's account balance in a big way, without adding to your financial burden.

Start saving early. We can't stress this enough.

You don't need to wait until your finances are in order to start saving. You don't even need to have a certain amount saved in order to open a 529 plan. Start today with $10!

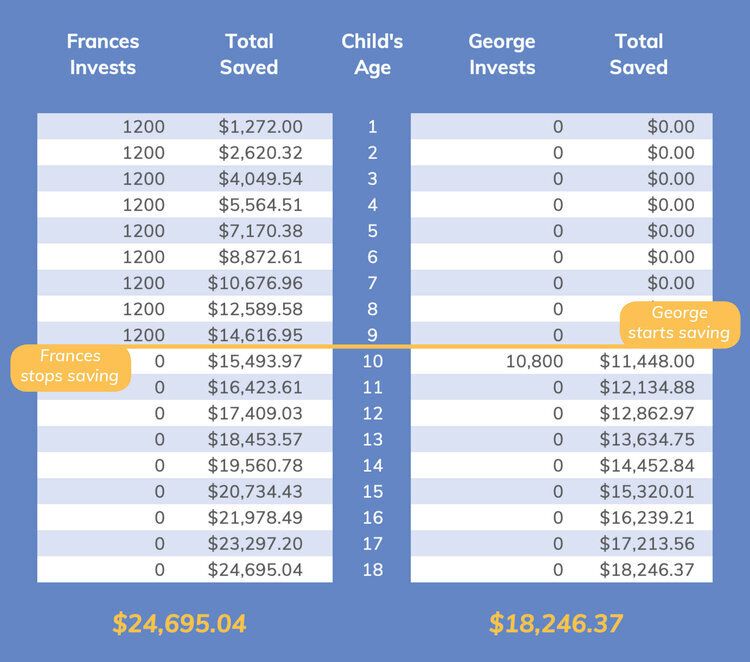

Remember we mentioned that 529 plans have compounding earnings? What that means is, your money makes money, day after day, year after year. So the sooner you put that money in a 529 plan, even if it's only $10, the more time your money has to go to work before you need it for college. Small, regular contributions to your plan can be just as effective, if not more than one large contribution at a later stage. Don't believe us? Check out this chart!

Get a little help from your friends

There are so many occasions where friends and family are already sending gifts to your little one, why not ask them to scale back on the gift a little and supplement it with a contribution to your kid's 529 plan? Or better yet, ask those that are really invested in your child's future, like grandparents to set up manageable recurring contributions to your child's plan.

Life is expensive, and crowd-funding has become the norm - what better to fund than the future generation's education? Bonus: It might even save some time-strapped friends a visit to the toy aisle on a Saturday ahead of your kid's birthday party. They might be thanking YOU before the day is over!

Buyer beware!

Before you head over to a regular crowd funding website, remember that crowd-funding, in general, is a gray area when it comes to taxes. Some campaigns have gone off without a hitch, whereas others have been derailed by the benefactor being stuck with a huge tax bill. There seems to be no rhyme or reason to this, and it's not worth risking losing a large chunk of your contributed money to tax when your child's education is at stake.

That's why it's so important to use a 529-specific crowd-funding platform, like Scholar Raise.

You get all the support and convenience of a crowd-funding platform, with all of the security and financial benefits of a state-run 529 plan.

What are you waiting for? Sign up for a NY State 529 plan (the best in the biz!) with Scholar Raise in 3 easy steps and with as little as 5 bucks and set your money to work for you! Don't forget to share your profile link with your loved ones, and watch your savings GROW!